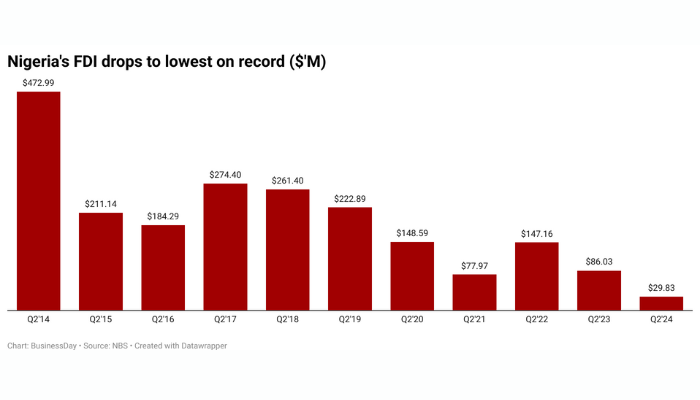

Foreign investors eyeing Nigeria do not only have an unstable currency to contend with but the uncertainty of how long it would take to get a Certificate of Capital Importation from the Central Bank.

The CCI is an official document that confirms the inflow of foreign capital into the country, and it is crucial for foreign investors looking to repatriate their funds or profits from investments in Nigeria.

CCIs are typically issued by commercial banks on behalf of the Central Bank.

But since Nigeria’s apex bank took up the role of issuing CCIs to investors, the process of obtaining one has become cumbersome, according to market sources familiar with the matter.

The delays in issuing CCIs only serve to exacerbate the risks associated with currency volatility, making Nigeria a more difficult destination for foreign capital.

“There is a backlog of CCI issuances that has left some offshore investors uneasy and others unwilling to bring their dollars,” one of the sources told BusinessDay. “It’s like the CBN scoring an own goal against itself.”

The CBN has made clear its desire to attract foreign capital into the country. Yields on Open Market Operation (OMO) bills, sold to banks and foreign investors, have jumped to 32 percent, the highest on record. The OMO bills also come with returns that match inflation for the first time since 2017.

T-Bill yields are also at their highest level in seven years.

The CBN has raised interest rates aggressively under new Governor Olayemi Cardoso in order to offer the FPIs a positive real return on investment. The CBN’s resolve has not flinched even when rate hikes have come at a hefty price for an economy where the high cost of credit is forcing businesses out of operations.

While the CBN seems eager to court foreign investors on one hand with its policies, it is frustrating the same investors with the bureaucratic bottleneck of a CCI issuance.

“Such a simple administrative issue such as issuance of CCI should never hold investors back from Nigeria, not even at a time like this when we need dollar supply,” another source familiar with the CCI matter said.

“The CBN should let the banks do it and revert to simply a supervisory role. Clearly the new approach is not working.

“What’s worse is that the rates are moving and for an investor who wants to exit, he could lose money to the naira depreciation while waiting in a queue for CCI,” the source said.

Naira on slippery slope

The naira fell on Monday to N1635 per US dollar compared to N1631 per dollar last Friday, as the embattled currency continues its free-fall despite the CBN’s best efforts.

The CBN sold $543.5 million to banks and customers in the month of September alone in an attempt to bolster the naira.

The sale comes after the bank sold some $876.26 million in a retail dutch auction in August, when it sold dollars directly to bank customers as concerns grew over the naira's collapse.

Last week, the Abuja-based bank also sold dollars to Bureau De Change (BDC) in a bid to halt the slide in the parallel market rate. The rate in that segment has however not budged with the naira hitting N1700/$.

One criticism of the CBN's dollar sales is that they have been too small and irregular.

Once bitten twice shy

Investors who won’t make a move on Nigeria until they obtain the CBN-issued electronic CCI have every reason to be careful.

The CBN had in 2018 fined four banks a total of NGN5.87 billion and ordered MTN Nigeria Communications Limited to refund US$8.134 billion to Nigeria after its examination revealed that the four banks, between 2007 and 2015, used irregular certificates of capital importation to repatriate foreign currency on behalf of MTN Nigeria offshore investors.

The timeline for the issuance of a CCI is within 24 hours of the receipt of the funds.