No nation has ever taxed its way to prosperity, but Nigeria seems to be following this misguided path.

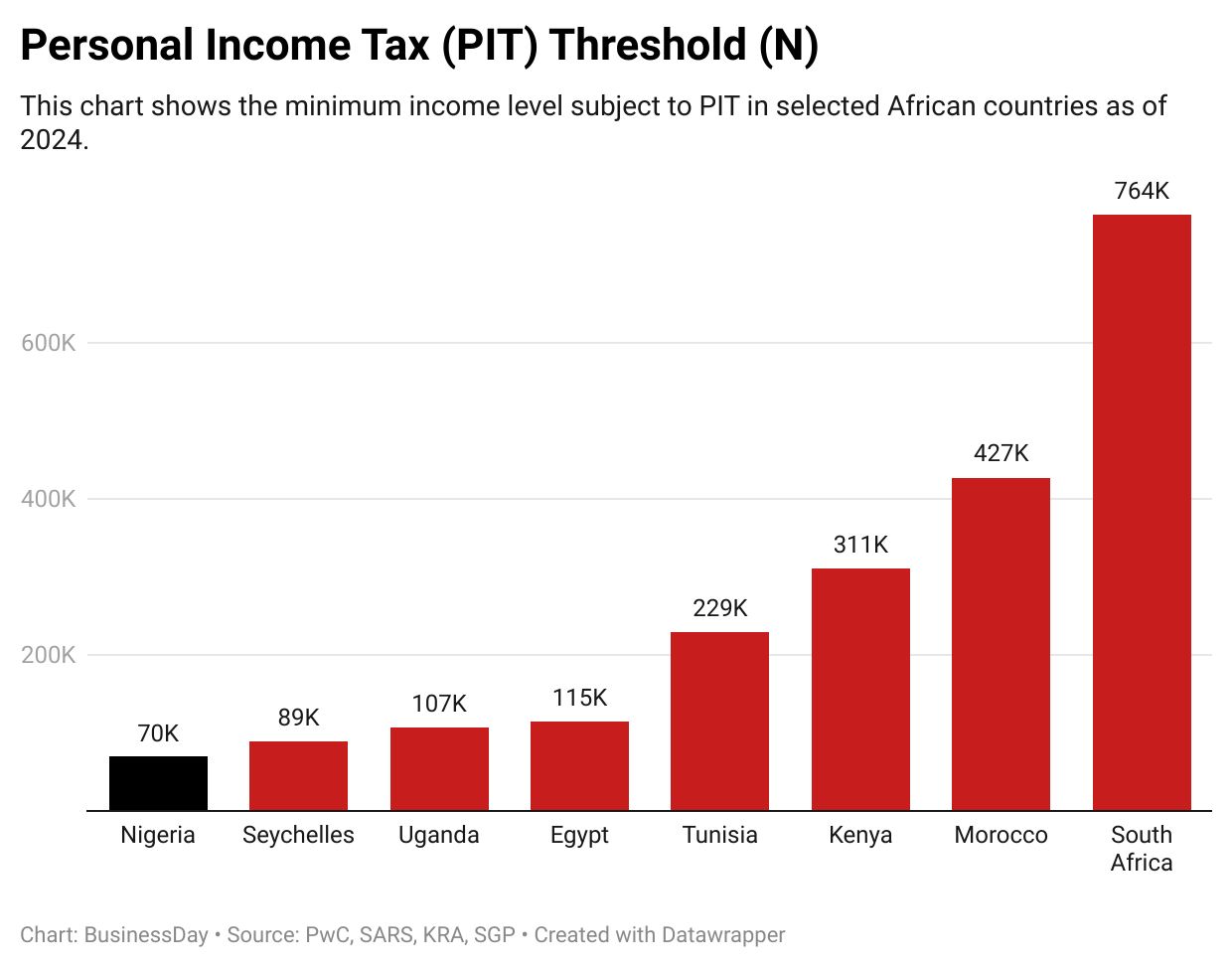

BusinessDay research finds that among eight selected African countries, Nigeria has the lowest threshold for Personal Income Tax (PIT) exemption, yet it collects the lowest revenue compared to South Africa and Kenya.

This clear contrast underscores a deeply flawed fiscal system, one that disproportionately burdens low-income earners while delivering minimal returns.

Great Britain, one of the world's first industrial powers, found itself bowing to the weight of extractive economic systems—that tax the poor without creating prosperity for them.

The lessons from Britain’s past have never been more relevant than today, as Nigeria grapples with fiscal mismanagement and misguided taxation.

Let’s go back to the reign of Queen Elizabeth I, who ruled England from 1558 to 1603. Faced with immense financial pressures due to wars, particularly with Spain, the Queen repeatedly begged Parliament to approve more taxes. These taxes fell heavily on the population, most of whom had little economic freedom to begin with.

At that time, monopolies ruled the day. The Crown granted exclusive rights to individuals or companies to sell particular goods, often driving up prices and causing widespread dissatisfaction. Parliament, realizing that taxation without reform would lead to chaos, began to demand concessions.

Among these was a restriction on the Queen’s power to create monopolies. What followed was a tug-of-war between the monarchy and Parliament, one that Parliament eventually won.

This conflict became a catalyst for England’s transformation into a more pluralistic society, paving the way for the Industrial Revolution.

According to economists Daron Acemoglu and James Robinson, the government’s embrace of inclusive institutions—protection of property rights, promotion of trade, and enforcement of the law—spurred innovation and economic growth.

It was this fertile environment that allowed inventors like James Watt, who perfected the steam engine, to flourish.

Elizabeth I lost the battle to tax the poor without reform, and England's government began laying the foundations for shared prosperity. The same principles apply today: for a nation to thrive, it must nurture economic opportunity, not stifle it with unfair taxes.

Nigeria's Taxation Dilemma

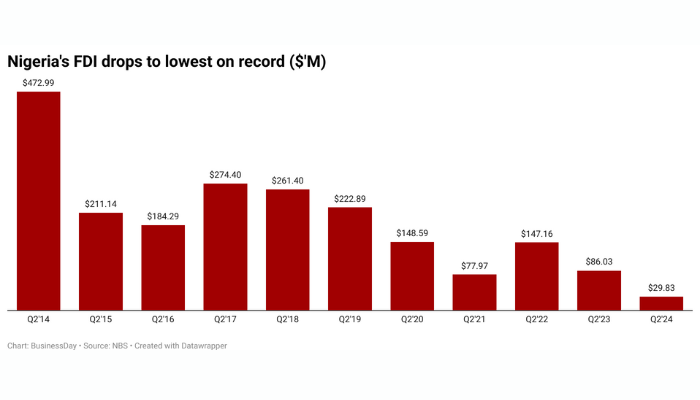

Nigeria faces a similar crossroads. Endemic fiscal mismanagement continues to erode the prospects of the average Nigerian, and yet, the government persists in taxing those least able to bear the burden.

The country’s current personal income tax (PIT) system, with its low exemption threshold of N70,000, disproportionately affects low-income earners.

In contrast, other African nations like South Africa and Morocco have much higher exemption thresholds, sparing the poorest citizens from the taxman.

The comparison is obvious. In 2023, Nigeria generated N1.53 trillion in PIT revenue, while Kenya despite a higher exemption threshold generated N5.8 trillion. South Africa, with its far more progressive tax system, brought in a staggering N50.5 trillion in the same period.

This wide gap underscores the inefficiency of Nigeria’s fiscal system and raises questions about its long-term sustainability.

The Economics of Taxing the Poor

Renowned economists have long argued against taxing the poor. John Maynard Keynes, the father of modern macroeconomics, advocated for a tax system that targets the wealthy.

His reasoning was simple: the rich have a lower marginal propensity to consume, meaning they can afford to pay more taxes without significantly reducing their spending.

By contrast, the poor spend nearly all of their income on basic necessities. Taxing them reduces consumption, stifles economic growth, and perpetuates poverty.

This economic principle is evident in the stark difference in local purchasing power between Nigeria and other nations.

According to Numbeo's 2024 data, Nigeria’s purchasing power index is just 9.4, one of the lowest in the world. South Africa, by comparison, boasts a purchasing power index of 84.7. This gap highlights how much more the average South African can afford with their salary compared to the average Nigerian. When purchasing power is low, so is quality of life.

The Path Forward: Reform and Growth

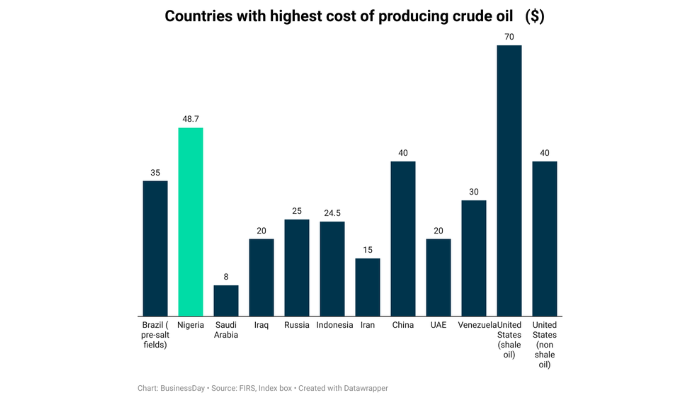

Economists argue that the key to sustainable tax revenue is wealth creation. Growing the economy increases the tax base, allowing the government to collect more without imposing excessive burdens on any one group.

As the base expands, so does the return on taxation. Conversely, taxing a narrow, impoverished base results in low returns and economic stagnation.

Nigeria’s ongoing tax reform efforts, particularly through the proposed Economic Stabilization Bill (ESB), aim to correct this imbalance.

One significant provision would raise the taxable income threshold to N1.5 million and above, offering relief to low-income earners. If approved and effectively implemented, this reform could help increase the purchasing power of Nigerian workers and provide a much-needed boost to the economy.

Conclusion: Prosperity Through Growth, Not Taxation

As Taiwo Oyedele, Chairman of the Presidential Committee on Fiscal Policy and Tax Reforms, wisely noted, “The best way to generate revenue on a sustainable basis is to grow your economy. When businesses grow and individuals prosper, you take a share of their prosperity by way of taxes.”

For Nigeria to truly prosper, it must follow this path. Taxing the poor has never, and will never, lead to shared prosperity. Instead, the government must focus on reforms that foster growth, empower citizens, and expand the tax base.

Only then can Nigeria chart a course toward lasting economic stability and improved quality of life for all.